HSM LAW

The Grand Court Reaffirms the Foundational Importance of Pleadings in Civil Litigation

Highlighting a recent case in the Cayman Islands, [2025] CIGC (FSD) 44 – Re Rasmala Trade Finance Fund (2) (“Re: Rasmala Trade Finance Fund (2)”), HSM Partner and Head of Litigation Kerrie Cox covers an important and often overlooked distinction Read more +

Vote HSM! Best of Cayman Islands 2025 Awards

We are proud to share that HSM has been nominated for the following Best of Cayman Islands categories: Immigration Law, Family Law, Divorce Law, Law Firm, Estate Law, and Immigration Services. Thanks to your support we won Gold in 2023 Read more +

HSM Response to Term Limits for Non-Caymanian Civil Servants

On 22 May 2025, the Government of the Cayman Islands published their intention to introduce term limits for non-Caymanian civil servants in the Cayman Islands. Civil servants have always been excluded from term limits. As such, these changes will require Read more +

Kerrie Cox Rejoins HSM Partnership, Bringing New Expertise

The HSM Group is pleased to announce that Kerrie Cox has rejoined HSM Chambers as a Partner to lead the firm’s Litigation and Insolvency practice. Kerrie practiced as a Barrister in the UK for over 12 years, before being admitted Read more +

Changes to Requirements for Residence based on Investment in Cayman Islands Real Estate

The Cayman Islands has long had opportunities for persons to gain residency in these Islands based primarily on investment in real estate. The options have included a Residential Certificate for Persons of Independent Means (a permission ideal for retirees and constituting a 25 year renewable certificate) and a Certificate of Permanent Residence for Persons of Independent Means.

On 26 May the Immigration (Amendment) (No. 4) Regulations, 2017 were published. These have changed the requirements for qualification and further, have added “back office” type businesses in Cayman Brac to the list of enterprises which meet the criteria for a Residency (Substantial Business Presence) Certificate.

For those interested, the No. 3 Regulations (published the same day) provided for a wide range of exemptions for persons involved in the music industry from any requirement to have a work permit, subject to them working in the Islands for no more than 6 months in any year. It is assumed that major recording activity is to be taking place here, a development sure to be welcomed, and typical of the type of industry that Cayman is so poised to entice to our shores. It bodes well for further economic diversification and those responsible should be congratulated.

A copy of the Immigration (Amendment) (No. 4) Regulations, 2017 is attached for your information. Some of the changes are (in our view) very positive. For example, rather than having to demonstrate an income of no less than CI$120,000 without having to engage in gainful occupation in the Islands, a deposit in a local account of at least CI$400,000 will be deemed to constitute confirmation that an applicant has available to them sufficient funds to maintain themselves in these Islands to an appropriate level. This development is particularly welcome as we have seen situations where persons with several million dollars in cash have been unable to become a resident in the Cayman Islands because (as they had not and did not wish to invest those funds, and interest rates being so low) they could not demonstrate an ability to generate CI$120,000 without having to work. Nevertheless, demonstrating that income as an alternative to holding significant funds on deposit in the Cayman Islands, remains an option.

That is however not the extent of the changes. The minimum required investment in the Cayman Islands for a retiree seeking residence in Grand Cayman through a Residential Certificate for Persons of Independent Means has increased from CI$500,000 to CI$1 million. For residence in Cayman Brac or Little Cayman the required investment has doubled from CI$250,000, to CI$500,000. In either event, up to half the required investment can be in something other than developed real estate. Raw land and shares in local businesses would appear to be appropriate options or, of course, CI$1,000,000 could simply be invested in a home. Unlike with the Permanent Residence points system, monies paid by way of stamp duty do not appear to count towards the threshold. The grant fee remains CI$20,000, with an additional CI$1,000 payable in relation to each dependant.

For persons seeking a Certificate of Permanent Residence for Persons of Independent Means, the required minimum investment in developed Cayman Islands Real Estate has increased from CI$1.6 million, to CI$2.0 million. There is no requirement that the investment be in residential real estate. The grant fee remains CI$100,000 with (again) a further CI$1,000 payable in relation to each dependant.

In other material respects the position required to qualify remains the same with applicants needing to demonstrate that (for example) they are of good character and conduct, and possess local health insurance.

The Regulations have further changed so that persons seeking and holding a Residential Certificate for Persons of Independent Means (but not a Certificate of Permanent Residence for Persons of Independent Means) are now required to not only pay CI$1,000 upon grant in relation to any dependants, but are also now required to pay CI$1,000 per dependant each and every year. There is most regrettably no clear transitional period and no confirmation (although it has been requested) as to whether or not the authorities will expect payment from existing holders of these certificates in respect to their dependants; even though when they applied for and obtained the certificates, no such payments were necessary. Should there be any attempt to charge annual fees to the dependants of persons who already have permissions to reside for a particular period, the lawfulness will be questionable and (we would propose) suitable challenge raised. We wait to see what the formal position is, and are hopeful that any concerns we hold as to the treatment of existing holders of such permissions, are ill-founded.

This annual CI$1,000 Dependant’s Fee has also been introduced in relation to the dependants of the holders of Certificates of Direct Investment and those who hold a Residency Certificate (Substantial Business Presence). Again, there is no confirmation as to the treatment of existing holders of such permissions.

Most lamentable is the fact that there has been no formal notification of intended changes, or transitional provision in relation to the introduction of this new regime. As can be imagined, it takes several months to prepare for applications of this nature. We have at least three clients who embarked on these applications prior to the change in the regulations, and made investments accordingly. In one instance, the main reason they did not apply for the actual certificate before the change in the regulations was due to delays issuing the required Land Registers.

The good news however is that the Cayman Islands are and remain a wonderful place for persons to invest and bring their families, and that mechanisms continue to exist whereby qualified individuals and their families can join the community we are so privileged to call home.

In order to assist you and any existing clients we have prepared the attached brochures which reflect the current changes and which we hope might be of assistance to you and those with whom you work in relation to that seeking and obtaining of appropriate permissions to live (and work) in the Cayman Islands.

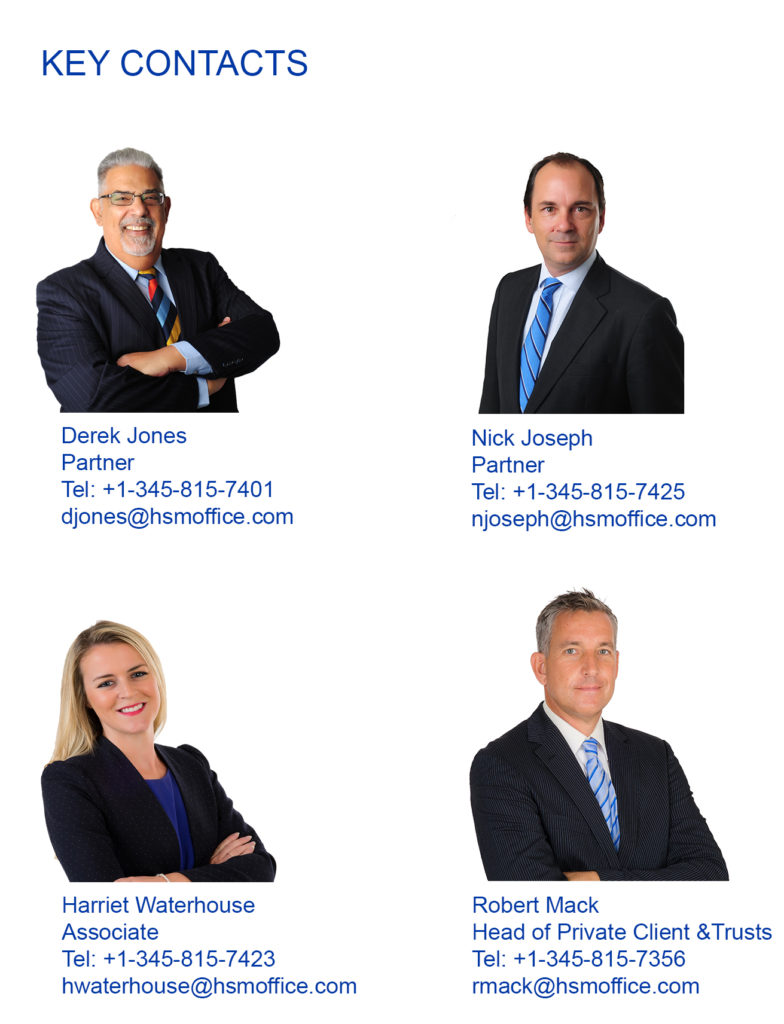

If you would like more information please contact us.