HSM Corporate Services

Cayman Islands Government Publishes Beneficial Ownership Transparency Act, 2023

Following the recent removal of the Cayman Islands from the FATF grey list, the Cayman Islands has published the Beneficial Ownership Transparency Act, 2023 to better align the beneficial ownership regime more closely with the Cayman Islands’ anti-money laundering regulations. Read more +

Action Needed for Cayman Companies that Own UK Property

As Russia’s invasion of the Ukraine continues, the United Kingdom has pushed its hunt for Russian Oligarch’s assets into high gear and has fast tracked the Economic Crime (Transparency and Enforcement) Act 2022 (the “Law”) into force. The Law was Read more +

Year-end Company Dissolutions Update and Reminder 2022

As we draw closer to the end of 2022, many clients will be considering their Cayman Islands structures and querying whether any entities are surplus to requirements. HSM’s Head of Corporate and Commercial, Peter de Vere, covers the key points Read more +

HSM Produces Updates to the Cayman Islands Economic Substance Regime

Most clients are now relatively familiar with the Cayman Islands Economic Substance regime requiring real economic substance for certain entities (known and ‘Relevant Entities’) carrying or certain activities (known as ‘Relevant Activities’). Our firm’s previous article on the introduction of Read more +

Cayman Islands Government Publishes Beneficial Ownership Transparency Act, 2023

Following the recent removal of the Cayman Islands from the FATF grey list, the Cayman Islands has published the Beneficial Ownership Transparency Act, 2023 to better align the beneficial ownership regime more closely with the Cayman Islands’ anti-money laundering regulations. While the Act provides that Cabinet may make regulations extending access to beneficial ownership registers to the general public, public access would only be implemented once further regulations are made and approved by Parliament and will be subject to a “legitimate interest test.” This will include access to parties who are genuinely seeking information so as to prevent or combat money laundering and terrorist financing (for instance media and civil society organisations under specific circumstances).

With implementing regulations to be introduced in a phased approach during 2024, the new law will bolster the Cayman Islands’ continuing commitment to transparency while also protecting privacy and confidentiality in line with evolving global standards and best practices.

The primary changes are to:

- introduce a new definition of beneficial owner;

- bring additional forms of legal entity within scope;

- remove and replace existing exemptions; and

- introduce additional line items for reporting purposes.

Affected entities and their corporate service providers will need to update their systems and processes urgently in order to satisfy these new requirements.

As is currently the case, ordinary resident companies, not engaging a corporate services provider for the provision of registered office services, must establish and maintain their own beneficial ownership registers.

Beneficial Owner

The overall objective of the regime is to ensure transparency of the beneficial ownership of Cayman Islands entities. Under the new law, a Beneficial Owner in relation to a legal person means an individual who either (a) ultimately owns or controls, whether directly or indirectly, 25% or more of the shares, voting rights or partnership interests in a legal person; or (b) otherwise exercises ultimate effective control (through a chain of ownership or other than by direct control) over the management of the legal person; or (c), where there is no individual fitting within (a) or (b), an individual who exercises control of the legal person through other means (for example as a director or a CEO), but does not include an individual acting solely as a professional advisor or professional manager as defined in the new law.

If no individual meets any of the criteria with respect to a legal person but the trustees of a trust meet one of the Beneficial Owner criteria, in their capacities as trustees of a trust, those trustees are then the beneficial owners of the legal person if they have ultimate effective control over the trust.

Extended Scope

The meaning of ‘legal person’ has also been amended to include partnerships (excluding foreign partnerships registered in the Cayman Islands) and extends to all companies (excluding foreign companies registered in the Cayman Islands); limited liability companies; foundation companies; limited partnerships; limited liability partnerships and exempted limited partnerships.

Removal and Replacement of Exemptions

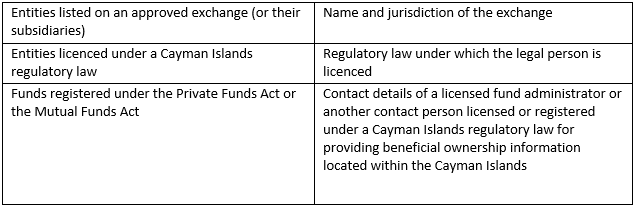

Former automatic exemptions for listed entities (or their subsidiaries), for entities licenced under a Cayman Islands regulatory law and for private and mutual funds will be replaced. Such legal persons will be required to provide written confirmation to their corporate services provider in order to show an alternative route to compliance as follows:

A licensed fund administrator or contact person for private or mutual funds will be required to provide the Registrar of Companies with the requested beneficial ownership information within 24 hours of a request being made or at any other time as the Registrar may reasonably stipulate.

All other exemptions will be removed.

Additional Required Particulars

Additional line items added to required particulars for individuals include nationality and the nature in which the individual owns or exercises control of the legal person.

Similarly, required particulars of a reportable legal entity will include the nature of the reportable legal entity’s ownership or its exercise of control of the legal person.

Conclusion

As a leader in ongoing anti-money laundering initiatives, the Cayman Islands continues to show its commitment to transparency with the publication of the Beneficial Ownership Transparency Act, 2023 in line with international standards.

With the Cayman Islands’ continued focus on quality, innovation and expertise, it seems reasonable to expect that the changes brought about by the Act will be absorbed by the market and in no way hinder the Cayman Islands’ continued success.

HSM can assist with all beneficial ownership matters and provide the necessary advice as to the application of the new beneficial ownership regime. Please connect with the key contacts below for any enquiries.

The HSM Group specialises in Corporate and Commercial Law, Litigation, Restructuring, Insolvency, Private Client, Immigration, Employment Law, Family Law, Property, Debt Solutions and Intellectual Property in addition to providing comprehensive corporate services through HSM Corporate Services Ltd.

This publication is intended only to provide a summary of the subject matter covered. It does not purport to be comprehensive or to provide legal advice. No person should act in reliance on any statement contained in this publication without first obtaining specific professional advice. Alternative solutions also exist which may better suit the requirements of a particular individual or entity.

Key Contacts:

Christian Victory

Partner / Head of Corporate and Commercial

Tel: 1 345 815 7360

cvictory@hsmoffice.com

Kathy Macdonald

Associate

Tel: 1 345 815 7356

kmacdonald@hsmoffice.com